Together with ITS, OJK Invites Digital Financial Literacy (DFL) Level Students

Keynote speech as well as introductory presentation of the Digital Financial Literacy (DFL) program by the Deputy Commissioner of the OJK Institute and Digital Finance Imansyah

ITS Campus, ITS News –In the development of the digital world, especially in Indonesia, the condition of financial technology (fintech) has developed very rapidly. To respond to these conditions, Institut Teknologi Sepuluh Nopember (ITS), together with the Indonesian Financial Services Authority (OJK), socialized the Digital Financial Literacy (DFL) program, which was held in a hybrid (offline and online) manner, Tuesday (26/10).

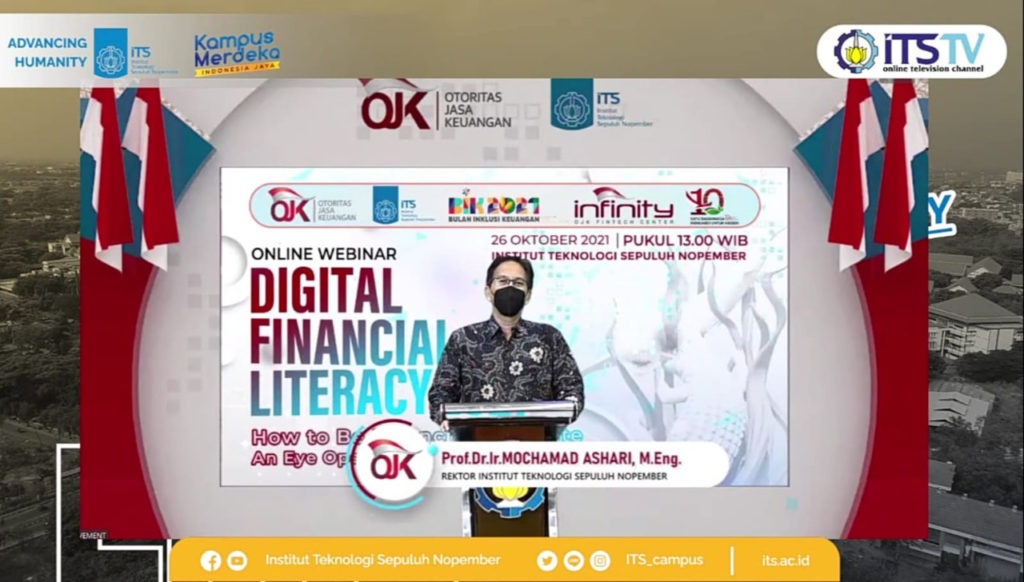

With the theme How to be Financial Literate: an Eye-Opener for New Generation, this event invites all ITS academics, especially students, to increase literacy in digital finance. This is intended to be a pioneer and an extension of the OJK’s (agent) in providing digital financial literacy to the surrounding community.

According to the Head of the OJK Regional IV Office for the East Java Region, Bambang Mukti Riyadi, the growth of fintech has become a daily necessity because it has penetrated all lines of society. Various financial transactions have been carried out digitally or cashless, shopping for everyday needs at the market, transportation tools, and educational needs.

Speech on the opening of the socialization of the Digital Financial Literacy (DFL) program by the Head of the Regional IV OJK Office for East Java, Bambang Mukti Riyadi

It was stated that fintech could be one of the solutions to accelerate the digitization of the financial services sector to accelerate the national economic recovery program after the Covid-19 pandemic. “However, in the process of adopting these fintech services, there are still big challenges, especially regarding the literacy level of digital financial services in the Indonesian people,” he explained.

Bambang explained the misalignment between the massive development of digital financial services and the low level of public literacy, which would harm economic growth in Indonesia. “For example, the case of fraudulent investment practices or what we usually call the Ponzi Scheme,” he explained in detail.

Welcome and acceptance of OJK leadership at ITS in a series of socialization events for the Digital Financial Literacy (DFL) program by ITS Rector Prof Dr. Ir Mochamad Ashari MEng

Agreeing with Bambang’s words, Deputy Commissioner of the OJK Institute and Digital Finance Imansyah explained that OJK had played an active role in increasing digital financial literacy and financial literacy cases from an early age. “One of them is by launching this DFL program,” he explained.

Furthermore, he said, this DFL program is one of the initiatives carried out by OJK aimed at providing education related to digital financial services and packaged interactively, attractively, and easily understood in the form of books, e-books, animated videos, and games with the main target being the millennial generation who have the potential to be the most significant users of digital financial services.

Imansyah expressed his appreciation and gratitude to ITS for being willing to work with OJK to realize the OJK program to provide an understanding of digital finance. “ITS is indeed very extraordinary in various social fields, especially DFL is already technology-based,” he said proudly.

Presentation of Digital Financial Literacy (DFL) and Digital Financial Innovation (IDK) materials by the Indonesian Financial Services Authority (OJK) for ITS academics

Ending this DFL socialization, he hopes that all ITS students and academics can understand more deeply the risks inherent in the use of Digital Financial Innovations (IKD) and other financial services, as well as ways to mitigate them so that it can make people more careful and wise in using digital services.

Several leaders from ITS and OJK also attended the DFL socialization event. ITS Rector Prof. Dr. Ir Mochamad Ashari MEng, Director of the OJK Digital Financial Innovation Group Dino Milano Siregar, Advisor of the OJK Digital Financial Innovation Group Widyo Gunadi, several other officials, and well-known influencer Reza Pahlevi. (ITS Public Relation)

Reporter: Fauzan Fakhrizal Azmi

Related News

-

ITS Wins 2024 Project Implementation Award for Commitment to Gender Implementation

ITS Campus, ITS News —Not only technology-oriented, Institut Teknologi Sepuluh Nopember (ITS) also show its commitment to support gender

October 26, 2021 11:10 -

ITS Professor Researched the Role of Human Integration in Sustainable Architecture

ITS Campus, ITS News –The developing era has an impact on many aspects of life, including in the field

October 26, 2021 11:10 -

ITS Sends Off Group for Joint Homecoming to 64 Destination Areas

ITS Campus, ITS News — Approaching Eid al-Fitr, the Sepuluh Nopember Institute of Technology (ITS) is once again facilitating academics who want

October 26, 2021 11:10 -

ITS Expert: IHSG Decline Has Significant Impact on Indonesian Economy

ITS Campus, ITS News — The decline in the Composite Stock Price Index (IHSG) by five percent on March 18,

October 26, 2021 11:10