Revolutionizing Toll Road Finance: A Path to ITS Doctorate

Muhammad Fauzan, when answering several questions from examining lecturers at the SIMT ITS Doctoral Promotion Open Session at the Bumi Hotel Surabaya

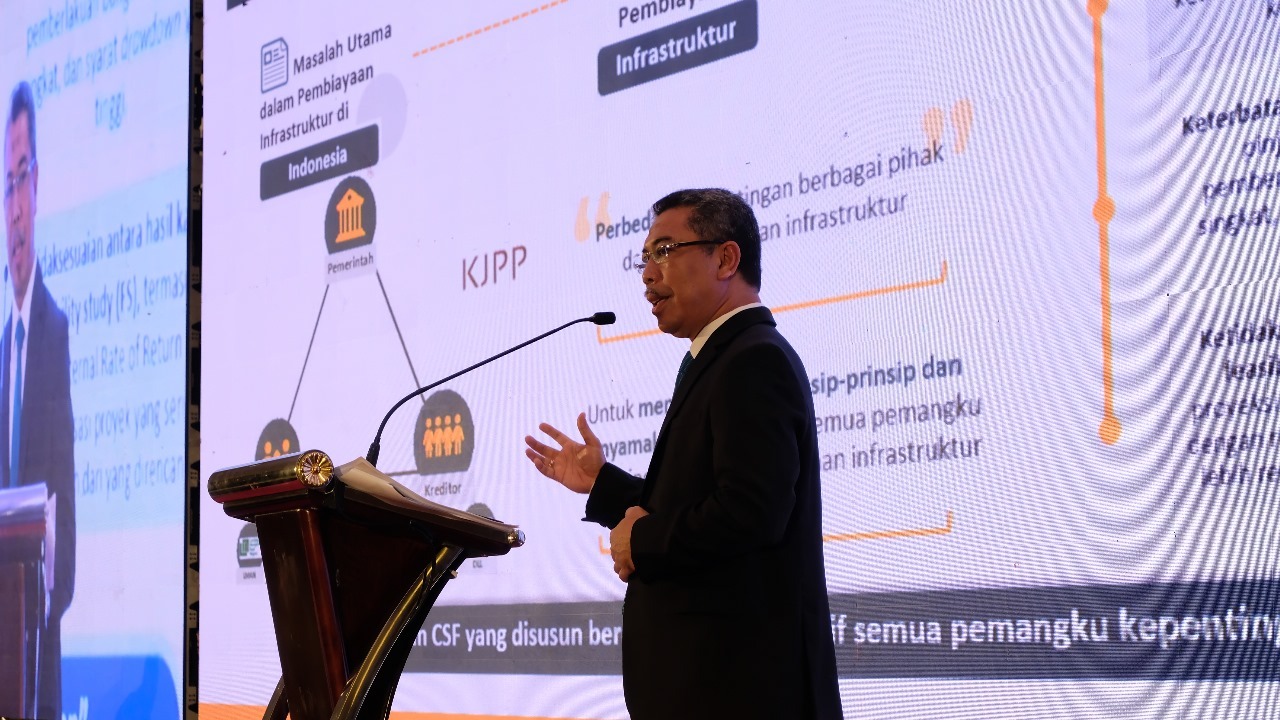

ITS Campus, ITS News –Financing efficiency is still not optimal, resulting in many infrastructure projects in Indonesia not going according to plan due to cost constraints. Seeing this, Doctor of Technology Management (DMT) program student Muhammad Fauzan looked at the factors of toll road infrastructure financing in his dissertation, which was presented at the Open Session for the Doctoral Promotion of the Interdisciplinary School of Technology Management (SIMT)Institut Teknologi Sepuluh Nopember (ITS) at the Bumi Hotel Surabaya, Monday (19/2) evening.

As someone who is experienced in the field of civil engineering, Fauzan explained that the limited amount of infrastructure is one of the main obstacles to the business world in Indonesia. However, problems that differ from those planning to develop this infrastructure still need to be solved. “Even with massive infrastructure funding planning, financing problems can still occur,” said the man currently serving as Director of Human Capital and Legal at PT Hutama Karya (Persero).

In delivering his dissertation, Fauzan focused on financing toll road infrastructure projects in Indonesia. So far, toll road financing in Indonesia still relies heavily on the State Revenue and Expenditure Budget (APBN). This encourages State-Owned Enterprises (BUMN) to seek funds by increasing the amount of debt. Therefore, the effectiveness and efficiency of financing are crucial in every development project.

This ITS Civil Engineering graduate also conducted his research using survey techniques among respondents with at least ten years of experience in road infrastructure in Indonesia. With 269 respondents, Fauzan gave a questionnaire about nine Critical Success Factors (CSF) influencing the success of toll road financing in Indonesia. “The nine CSFs were selected based on research results from previous CSF reviewers,” explained Fauzan.

Muhammad Fauzan, when conveying the impact of his research in a dissertation presented at the ITS SIMT Doctoral Promotion Open Session

The man born in Bengkalis on April 6, 1973, continued that of the nine CSFs in this research, seven CSFs influenced the successful implementation of toll road infrastructure financing in Indonesia. Of the seven CSFs, three CSFs greatly influence the funding of toll road infrastructure in Indonesia. The three CSFs include Risk Analysis Allocation (RAA), Investment Analysis (IA), and Debt Payment Mechanism (DPM).

Fauzan used assessment indicators for each CSF studied to assess the CSF. Apart from that, Fauzan also used structural equation modeling (SEM) analysis with bright partial least squares (PLS) to test the relationship between the CSFs studied.

For example, CSF RAA positively and significantly influences infrastructure financing success (KPI). A significance level of 0.008 shows that the more influential the RAA, the higher the financing success. This is because RAA includes risk evaluation and allocation, including political, location, construction, completion, and operational risks.

Muhammad Fauzan (right) receives a bouquet from his wife, Niluh Putu Dewi Kartikasari SE MBA after being declared a doctorate from SIMT ITS

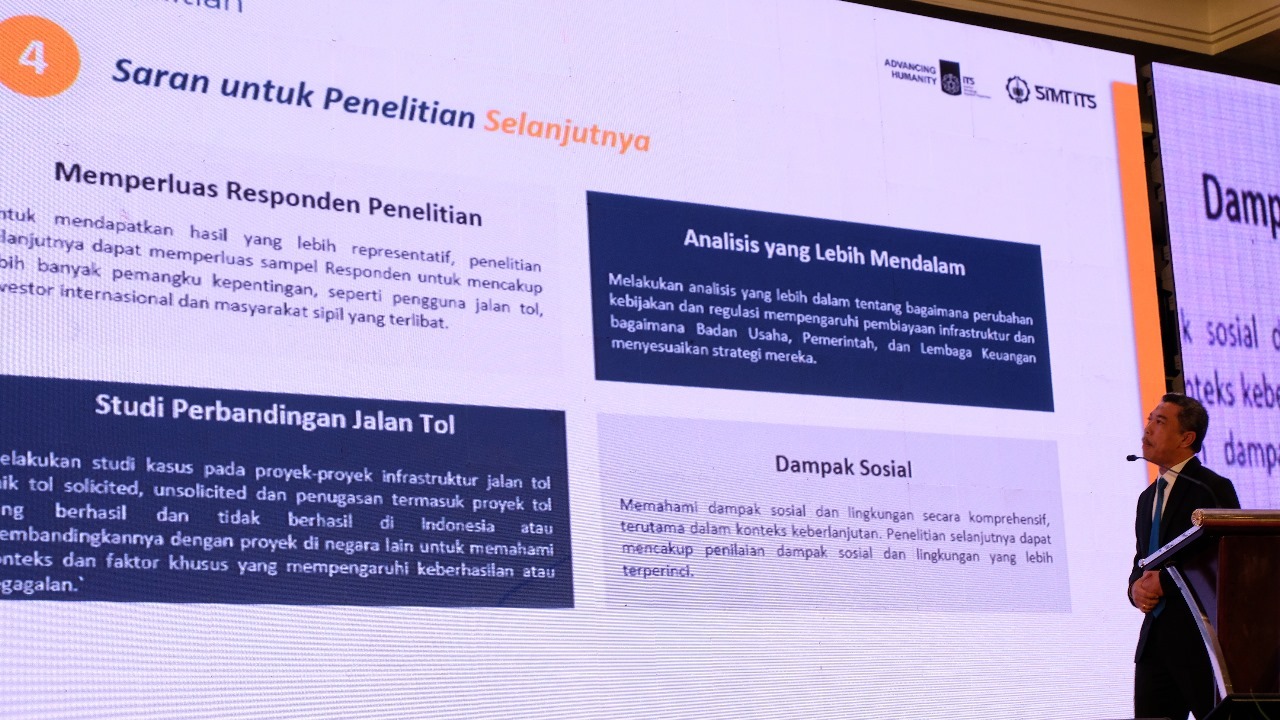

The former President and Director of PT Hutama Karya Realtindo emphasized that infrastructure development programs must be done according to the plan. That way, all elements can comfortably enjoy infrastructure results, starting from the community, government, and private sectors. The infrastructure sector, especially toll roads, greatly influences economic dynamics. “Hopefully, this research can help policymakers and toll road practitioners in the future,” Fauzan hoped. (ITS Public Relation)

Reporter: Gandhi Kesuma

Related News

-

Facilitating Creativity of Students, ITS Information Systems Department Presents CCWS

ITS Department of Information Systems students conduct a discussion in one of the available spaces in the ITS Digital

February 20, 2024 16:02 -

ITS Explores Electrification Cooperation with PT Vale Indonesia

ITS Campus, ITS News — Following up on the Memorandum of Understanding (MoU) with PT Vale Indonesia, Institut Teknologi

February 20, 2024 16:02 -

ITS Reaches Top 7 BRIN Collaborators with 309 Scientific Publications

ITS Campus, ITS News — Institut Teknologi Sepuluh Nopember (ITS) continues demonstrating its commitment to strengthening collaboration in research

February 20, 2024 16:02 -

The Only One from Indonesia, ITS Student Becomes Erasmus+ Scholarship Awardee

ITS Campus, ITS News — Civitas academica of Institut Teknologi Sepuluh Nopember (ITS) has once again contributed to making

February 20, 2024 16:02