Purpose

Sustainable investment is a practice aimed at achieving financial returns while promoting long-term environmental or social value. Sustainable investment is oriented towards three dimensions, namely environmental, social, and corporate governance. Institut Teknologi Sepuluh Nopember (ITS) strong commitment to environmental responsibility is exemplified by the significant impact of the Regulation of ITS’ Board Trustees (MWA) No. 9/2016, guiding sustainable investments at ITS. As stated in Article 12 the Rector is responsible for the implementation of investments and further provisions regarding the implementation of investments and business units will be further regulated by the Rector’s regulations.

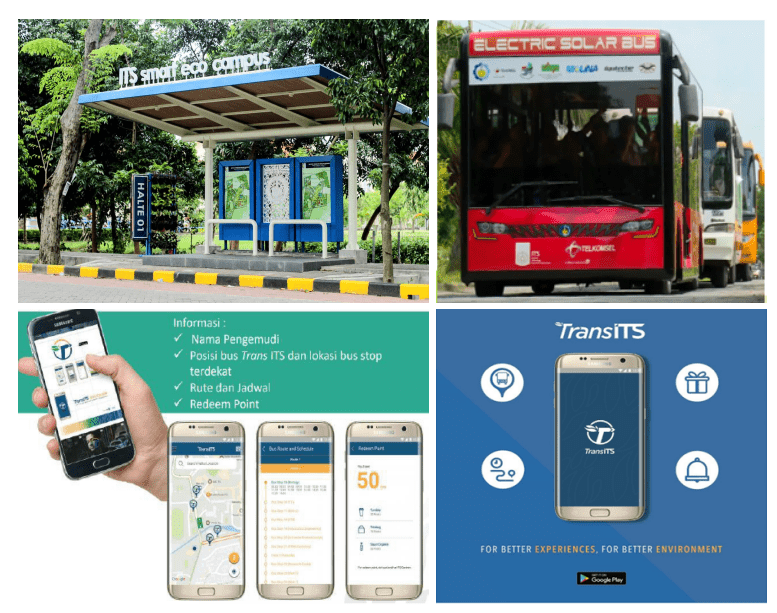

Institut Teknologi Sepuluh Nopember has ambitious plans to achieve net zero carbon in the future. This investment policy aims to be able to run in the same direction as the sustainability development goals strategy, starting from the Environmental, Social, and Governance aspects. This investment also aims to contribute to the country, campus development, and increase income

Scope

This policy covers scope in terms of goods, money, or other sources. Investment is applied to all work units at ITS to be able to continue developing SDGs towards zero carbon emissions.

Objectives

1. Environmental: ITS is committed to achieving zero carbon emissions by implementing sustainability principles, therefore ITS always considers investing in companies that have SDGs principles

2. Social: ITS is open to investing in companies that value diversity, help people with disabilities, and respect work ethics.

3. Governance: Invest in companies/organizations that have anti-corruption principles and are always transparent in financial affairs.

Investment Strategy

1. Our in-charge investment will actively engage with companies to promote the adoption of best practices in environmental, social, and governance.

2. Regular reviews, updates, and evaluations will ensure ongoing alignment of our practices with the sustainability objectives.

3. When investing in companies, we will take environmental and social considerations, recognizing that socially sustainable companies are more likely to succeed in the long term.

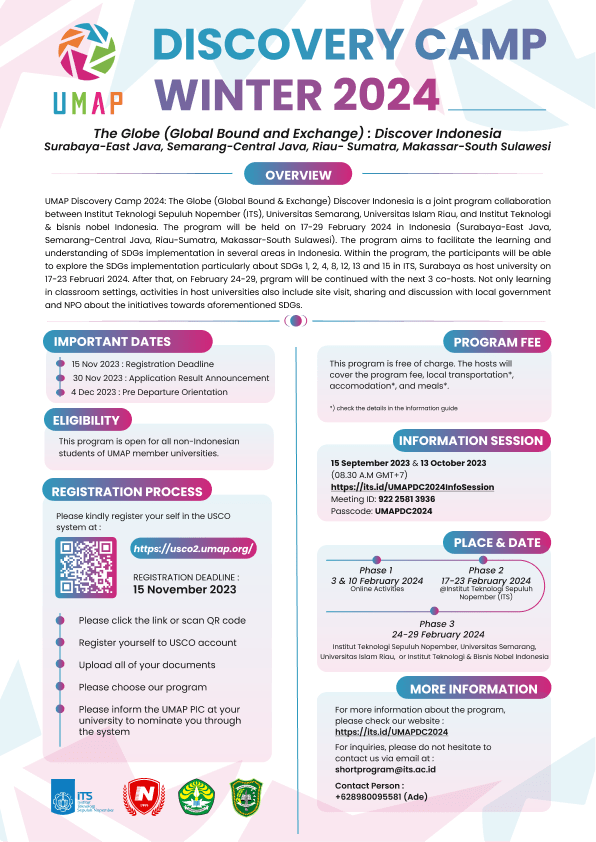

4. We will pursue partnerships with other institutions, organizations, and industries to enrich our understanding, exchange best practices, and push innovation in sustainable investing.

5. Emphasize reporting, benchmarking, and continuous improvement.

6. Promote awareness of sustainable investing among faculty, staff, and students through educational programs, seminars, workshops, etc.

Responsibilities

Rector, Vice-Rector, heads of faculties, work units, and departments are responsible for the Sustainable Investment Policy which is by the principles of sustainability and by applicable laws in Indonesia. Every faculty, unit, and department is required to comply with and apply the principles of sustainability in terms of investment as well as managing and reporting the results of these investments following the rector’s regulations.